The Red Carpet

The Fame Game

Welcome back to The Fame Game. This week, I'm answering the question I get pitched constantly: "Why don't celebrities just crowdfund from their millions of followers?" At least three times a month, someone proposes this "obvious" solution to celebrity funding.

It's a fair question. On paper, equity crowdfunding seems perfect. Celebrity gets capital while building a community of fans who are now co-owners and brand ambassadors. Fans get to invest in their idol's business. Everyone wins together when the brand succeeds.

Except that's not how it usually plays out. Today, I'm breaking down the hidden dangers of crowdfunding, the reputation risks that come with taking fan money, and why these downsides were enough to make even MrBeast reconsider this approach.

Create how-to video guides fast and easy with AI

Tired of explaining the same thing over and over again to your colleagues?

It’s time to delegate that work to AI. Guidde is a GPT-powered tool that helps you explain the most complex tasks in seconds with AI-generated documentation.

1️⃣Share or embed your guide anywhere

2️⃣Turn boring documentation into stunning visual guides

3️⃣Save valuable time by creating video documentation 11x faster

Simply click capture on the browser extension and the app will automatically generate step-by-step video guides complete with visuals, voiceover and call to action.

The best part? The extension is 100% free

The Director's Cut

The Perfect Pitch That's Too Good to Be True

Celebrities and creators have millions of followers. And every one of those followers is a potential investor.

That's the pitch I hear constantly. Why raise from a handful of VCs when you could raise from millions of fans? The theoretical benefits are compelling.

For the celebrity, it's a capital-raising dream. Build a community of fan-investors who become natural brand evangelists. Generate massive PR from the campaign itself. Skip the VC pitches and raise from people who already believe in you. Every investor becomes a built-in ambassador, spreading the word organically.

For the fans, it's even more appealing. They get to invest alongside their favorite celebrity in what could be the "next big thing." But it's about more than potential returns. They now have a direct connection to their idol. Shareholder updates, exclusive events, the ability to say "I'm a co-owner" of their favorite creator's company. It transforms the parasocial relationship into something tangible.

With celebrities commanding audiences of 10, 20, even 100 million followers, the math seems obvious. If just 1% invest $100 each, that's millions in funding.

Sounds perfect, right? Everyone wins together.

Here's the problem: Startups fail. A lot.

The Reality Check Nobody Wants to Hear

For every SKIMS and Fenty, there are hundreds of celebrity-founded brands that crash and burn. The statistics are brutal:

90% of startups fail within 5 years

Celebrity-founded brands aren't immune to these odds

Most never reach $10M in revenue

Even fewer achieve profitability

When a traditional investor loses money, it's part of the game. When a fan loses money on their idol's company? That's when things get ugly.

The Noah Schnapp Case Study

Noah Schnapp, the Stranger Things actor with 31 million Instagram followers, launched TBH in 2021. A guilt-free hazelnut cocoa spread. Premium positioning. Celebrity founder. Gen Z audience.

The pitch was perfect: "Invest in the next Nutella, backed by your favorite actor."

Schnapp leveraged his massive fanbase to raise $591,844 from 950 investors. Many were young. Most were first-time investors. Some invested money they couldn't afford to lose.

Today, the company doesn’t seem to be operating anymore.

Let that sink in. 950 fans lost money believing in their favorite celebrity. The average investment? $623. For a young fan, that's a month of rent. Two car payments. Money that actually matters.

But the financial loss was just the beginning. The real damage was to trust.

What do you think those 950 fans think about their "favorite celebrity" now? They don't see him the same way anymore. That trust was built over 10+ years of watching him grow up on screen. Destroyed with one crowdfund.

And this matters beyond hurt feelings. The less trust you have from your audience, the less relevant and interesting you become for brands to work with. One crowdfunding campaign didn't just lose $591,844 of fan money. It potentially cost Schnapp millions in future brand deals and opportunities.

The Gemma Atkinson Backlash

Or look at Gemma Atkinson, the British actress and radio presenter who turned to crowdfunding to raise £500K for Gem & Tonic, her new beauty brand. The brand focuses on science-backed skincare solutions.

The backlash was immediate and brutal. Within hours of announcing the crowdfunding campaign, her social media became a warzone.

"Why hasn’t she used her own money?"

"So she wants people to help her… doesn’t she know about the cost of living crisis us normal people are dealing with?"

"Crowdfunding to make herself rich?"

"Bloody hell, she has more money than most!"

"Clearly not confident in her own idea to fully invest herself, putting up her property as collateral.”

What should have been an exciting brand launch became a reputation crisis. The crowdfunding angle overshadowed everything else about Gem & Tonic.

The MrBeast Thought Experiment

Even MrBeast was thinking about doing a form of crowdfunding through an IPO for his companies. He publicly tweeted: "Maybe I should ipo Feastables and Beast Burger while they're relatively small so you guys can share in the growth. Feel pretty confident we can easily 100x the rev we are doing. But idk if that'd make my life 2 stressful or not haha"

But luckily for him, he didn't do it.

Because where are those companies today? Feastables is crushing it. Beast Burger? Doesn't exist anymore.

If MrBeast had followed through with that IPO, imagine the split reality. Fans who invested in Feastables would be celebrating their gains. But the ones who backed Beast Burger? They'd be furious.

Not disappointed. Not understanding. Furious.

Taking fan money changes everything. The relationship. The expectations. The consequences of failure.

Fans Can't Make Objective Investment Decisions (And Celebrities Should Protect Them)

Here's the uncomfortable truth nobody wants to admit: When fans invest in celebrity-founded brands, they're not making rational financial decisions. They're buying into a parasocial relationship.

A professional investor would ask: What's the TAM? What are the unit economics? What's the competitive moat? Fans ask: Will this make me closer to my idol?

Don't believe me? Just look at all the celebrity crypto coins that crashed. Fans invested millions because their favorite celebrity said so. Not because of the technology. Not because of the use case. Because their idol promoted it.

This dynamic is exactly why celebrities have a moral responsibility to protect their fans from themselves. Your 19-year-old superfan shouldn't be risking their college fund on your kombucha startup. But if you open the door, they will.

The power imbalance is too great. The emotional investment too deep. The financial literacy gap too wide.

Am I Completely Against Crowdfunding?

After all these warnings, you might think I'm completely anti-crowdfunding. I'm not. But timing and structure make all the difference.

In my opinion, crowdfunding makes sense after companies have found product-market fit. When you've already proven demand, validated operations, and shown consistent growth, the risk profile completely changes. You're no longer asking fans to fund an idea like Noah Schnapp and Gemma Atkinson did. You're inviting them to invest in proven success.

This feels fundamentally different to fans. Now you want to share your success with them, not your risk. The critics quiet down because you're offering them a piece of something real, not a dream that might fail.

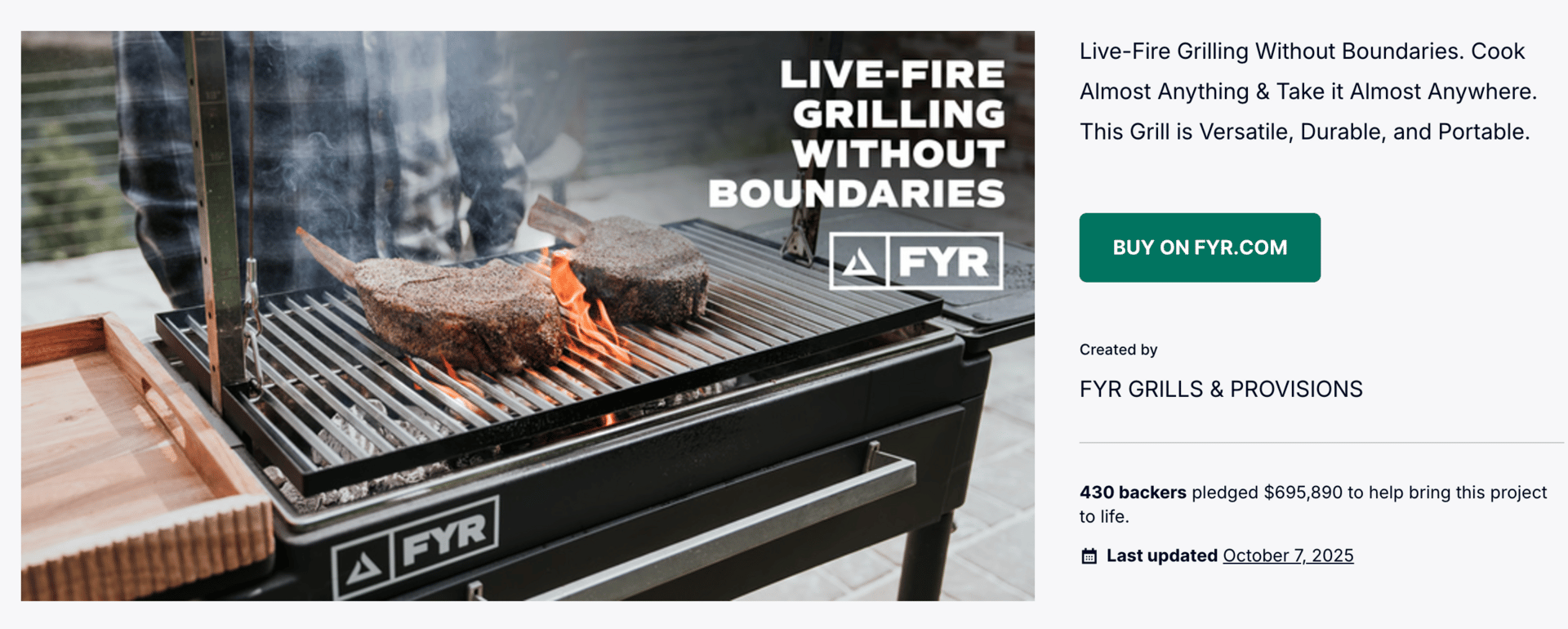

Or consider alternative crowdfunding structures like product crowdfunding to fund inventory and expansion. One of our portfolio companies at HotStart, FYR, raised $695,890 from 430 backers on Kickstarter pre-selling their patent-pending grill. FYR is a live fire cooking brand co-founded by Derek Wolf, a creator with millions of followers passionate about BBQ and outdoor cooking.

This structure provides the validation and working capital needed without the complexity and emotional baggage of making fans co-owners. It's crowdfunding that works for everyone involved.

Both later-stage equity crowdfunding and product crowdfunding can be excellent ways to raise capital and get your community involved. The key difference? They protect the celebrity's reputation while still leveraging fan support. You're building trust, not risking it.

The Bottom Line

Celebrities asking fans for investment money is like asking your kid to co-sign your mortgage. The power dynamic is too broken to be ethical.

Your fans love you. They trust you. They'll invest money they can't afford to lose because you asked them to. Not because it's a good investment. Because it's you.

That's not empowerment. That's exploitation.

The few times crowdfunding works? After you've already built a real business. When you're sharing proven success, not selling dreams. Or when you're pre-selling actual products like FYR did on Kickstarter.

But taking equity investment from the people who made you famous? From fans who can't separate their emotional connection from financial reality?

That's not building community. That's betraying it. And once that trust is gone, you can't crowdfund it back.

If you want to revolutionize how celebrities fund businesses, start with this: Protect your fans from their own devotion. They'll thank you for it later.

Even if they don't understand it now.

The Mic Drop

Alison Roman launches A Very Good Sauce

Creator Alison Roman just launched A Very Good Sauce, proving the best time to launch a food brand isn’t at peak fame but when the product actually matters. Her lineup, including Classic Garlicky Tomato, Spicy Tomato with Fennel, and Caramelized Shallot and Anchovy, turns her viral recipes into products her audience already knows how to use. Starting small with direct shipping and select NYC and Catskills stores, Roman built a brand based on trust, not trends—a very good sauce and a very good business.

Future launches Roué, a wine and cocktail brand

Future, the Grammy-winning musician, has co-founded Roué, a beverage company offering a curated selection of wines and ready-to-drink cocktails. The brand aims to make wine and cocktail culture more accessible and modern, combining thoughtful craftsmanship with a fresh approach. Roué’s initial lineup includes a red and white wine along with two signature cocktails, now available in select states and online for nationwide delivery.

Travis Kelce Joins Investor Group in Six Flags

Kansas City Chiefs star Travis Kelce has invested in Six Flags Entertainment Corporation, acquiring approximately 9% of the company alongside activist investor JANA Partners and executives Glenn Murphy and Dave Habiger. Kelce, a lifelong fan of Six Flags, aims to enhance both shareholder value and the guest experience at the parks. This move comes amid challenges for Six Flags, including financial losses and leadership changes, as the company seeks to revitalize its brand and operations.

HotStart VC’s Backstage Pass

Selena Gomez’s Serendipity Frozen Heads to College

Portfolio company Serendipity Frozen, the premium ice cream brand co-founded by Selena Gomez, is expanding its reach beyond grocery aisles, now available at major university campuses and football stadiums, including Texas Tech, Arizona State University, University of Colorado Boulder, and UNC Chapel Hill, among others.

Portfolio Company Hippie Water Expands to Total Wine & More

Portfolio company Hippie Water, co-founded by actress and entrepreneur Sasha Pieterse, is now available at Total Wine & More locations nationwide. Each flavor is crafted with real fruit juices and lightly sparkling, designed to help you relax, recharge, and feel your best, without alcohol or next-day regret.

Take #17

The celebrity crowdfunding question isn't about innovation or democratizing investment. It's about reputation risk and moral responsibility. And after watching these deals play out, the math is brutal.

Here's the reality: When your fan loses money on your equity crowdfund, they don't just lose an investment. They lose their connection to you. Multiply that by thousands of fans, and you've traded your entire career for startup capital.

Smart celebrities are realizing the real cost isn't worth it. They're either waiting until after product-market fit when the risk profile completely changes, or exploring alternatives like product crowdfunding where fans pre-order products instead of buying equity. Both protect what matters most: the trust between creator and audience.

At HotStart VC, we help celebrity founders raise capital without risking their most valuable asset: their relationship with fans. Because in a world where trust takes decades to build and seconds to destroy, protecting your audience isn't just good ethics. It's good business.

Remember: Your fans made you famous. Don't make them poor.

Welcome to the fame game, Scott

P.S. I would love to get your feedback on this newsletter. Any suggestions on how I can improve it?

—----

About HotStart VC

HotStart VC is launching a new fund to invest in brands founded by celebrities and creators. We’re building the go-to platform for creators and celebrities launching brands, providing capital, strategic support, and the infrastructure to scale.