The Red Carpet

The Fame Game

Welcome back to The Fame Game, where we decode how celebrities and creators build billion-dollar businesses. This week, we're revealing the strategy that's revolutionizing creator partnerships: why smart brands are turning creators into co-owners, and how this model is creating the next wave of billion-dollar consumer brands.

Here's what made me dig into this: When live-fire cooking content creator Derek Wolf recruited 20 competing BBQ influencers as equity partners in his grilling brand FYR, I thought it was a one-off experiment. Then Jake Paul assembled his "Avengers" of equity partners for W. Both hit revenue milestones faster than any traditional influencer campaign could deliver. FYR hit 7-figures in revenue in a couple of months. W scaled to 8-figures faster than any personal care brand in history.

This is something completely new. We're witnessing the birth of Creator Stock Option Pools (CSOPs), and I predict that within 18 months, every smart consumer brand will have one.

The data shows this isn't just influencer marketing with better contracts. It's a fundamental shift in how consumer brands achieve market dominance. While traditional brands pay influencers for posts that disappear in 24 hours, brands with CSOPs are building armies of creator-owners who compound value for years. And for founders trying to compete against billion-dollar incumbents, creator equity pools aren't just a growth hack. They're the only way to win markets that traditional advertising can't penetrate anymore.

The Director's Cut

From ESOPs to CSOPs: The Evolution of Equity Incentives

Companies have been using Employee Stock Option Pools (ESOPs) for decades. The logic is simple: when employees own a piece of the company, they work harder, stay longer, and think like owners instead of renters. They feel invested in the outcome because they literally are.

Silicon Valley perfected this model. Google's early employees became millionaires. Facebook's first 100 employees are worth billions. At NVIDIA, 80% of employees are millionaires, many are multi-millionaires who could retire tomorrow. Yet they stay and build further. Why? Because ownership changes everything.

Then startups started experimenting. Instead of just giving equity to employees, why not give it to celebrities and creators? Make them co-founders. By granting equity, startups align long-term interests with creators, creating opportunities for shared value appreciation.

This worked brilliantly. Jessica Alba transformed The Honest Company from a startup to $1.4B IPO. Ryan Reynolds helped Mint Mobile scale to a $1.35B acquisition. One celebrity co-founder could transform a startup's trajectory overnight. Their audience became your customers. Their credibility became your marketing. Their success became your success.

But now something new is emerging: the Creator Stock Option Pool (CSOP).

The Birth of Creator Equity Pools

Instead of granting equity to one person, startups are creating CSOPs similar to ESOPs, setting aside 10-15% of their company to onboard multiple creators as co-owners.

The fascinating part? Even brands already founded by massive celebrities and creators are doing this.

One company we invested in did this brilliantly. FYR, a live-fire cooking brand co-founded by Derek Wolf, a cooking creator with 9 million followers. You'd think that was enough reach. Instead, Wolf invited 20 of the other largest live-fire cooking content creators to come on board as equity partners. Together, these creators reach a combined 40 million followers, generating over 1 billion monthly impressions.

What is cool about FYR's structure is that those creators are normally competing for the same brand deals, the same audiences, and the same grocery store shelf space. In this structure, they are working together to create a category-defining brand.

Another celebrity-founded company pioneering this model is W, co-founded by Jake Paul. Since launch, he's taken a unique approach to building it: instead of going solo, he's onboarding high-profile equity partners to help scale the brand.

So far, Jake has brought on:

Sean O'Malley (UFC)

Rubi Rose (actress and model)

Arcangel (LATAM music artist)

Livvy Dunne (college athlete and influencer)

Jutta Leerdam (Olympic speed skater and Jake's partner)

Jake refers to this group as his version of "the Avengers", a hand-picked team of cultural powerhouses who each bring their own superpower (also known as audience) to the table.

The Math That Makes It Irresistible

And the reasoning behind this is simple:

Traditional influencer math: Pay 20 creators $10,000 each = $200,000 for posts that disappear in 48 hours.

Creator equity math: Give those same creators 0.5% equity each = 10% dilution for creators posting weekly for years.

Same Strategy, Different Approach

FYR and W are executing the same strategy with different approaches.

Combined approaches:

Create exponential reach beyond the original celebrity co-founder's audience

Build resilience through distributed ownership. No single point of failure or key-man-risk

Different approaches:

FYR focuses on onboarding similar creators like Derek Wolf. That helps them create deeper awareness within one specific customer group: outdoor and food lovers. FYR also leverages their experience in product development as they have a combined 350+ years of grilling experience and know how to improve current products. The result: patent-pending products, like FYR's flagship grill.

W onboarded different types of creators who all have different target audiences. This helped with distributed star power and reach more customers, not go deeper into one target audience:

Sean O'Malley (UFC) → Combat sports culture

Ruby Rose (actress) → Women and Black community

Arcangel (musician) → Latin American markets

Livvy Dunne (athlete) → Gen Z sports fans

Jutta Leerdam (Olympian) → Women and European community

The CSOP Framework That Actually Works

So, how should you start thinking about this? In a previous newsletter (see link here), I broke down how to structure an equity deal with an individual creator or celebrity. That framework still has valuable insights, but CSOPs require a different approach. You can't expect someone with 0.5% equity functioning as an ambassador to have the same terms and expectations as someone who has a 20% equity stake, acting as a co-founder.

Based on our experience, here's what works. Though remember, it depends on many factors like the stage of the company, deliverables, and more:

Equity Structure:

Macro creators (1M+): 0.5-1% each

Mid-tier (100K-1M): 0.25-0.5% each

Micro (10K-100K): 0.1-0.25% each

Total pool: 10-15% max

Vesting Requirements:

Monthly, quarterly, and yearly vesting based on deliverables

Monthly posting minimums

Performance accelerators

Buy-back provisions

Why Traditional Brands Can't Compete

P&G spends $8 billion on advertising. But they're buying impressions, not owners.

CSOP brands don't run ads. They activate owners. When FYR launches a new product, 20 creators simultaneously create authentic content about why they helped design it. When W enters a new market, their equity partners create localized content that resonates with their specific audiences.

Try buying that authenticity with an ad budget.

This fundamental advantage is why the CSOP model is evolving faster than anyone predicted.

The Future of CSOPs

This is just the beginning. We expect every smart consumer brand to build a CSOP within 18 months. Here's what's coming:

Horizontal Integration: Brands recruiting different types of creators to expand market reach. Instead of 20 fitness influencers, imagine 5 fitness creators + 5 nutritionists + 5 celebrity trainers + 5 wellness podcasters. Different audiences, same cap table. Same equity alignment, exponentially more reach.

Category Monopolies: Brands recruiting EVERY creator in a niche to own the conversation. One brand we're tracking is quietly approaching every language teacher on YouTube. If they succeed, they'll control how 100 million people learn languages. When you own all the voices, you own the market.

Exit Premium Revolution: Strategic buyers will pay massive premiums for brands with CSOPs. When Unilever buys your brand, they're not just buying products and revenue. They're acquiring 20 locked-in media channels with contractual obligations. That's worth 3-5x more than a traditional brand.

The Bottom Line

The creator economy isn't a marketing channel anymore. It's an ownership revolution.

Traditional brands think in campaigns. CSOP brands think in decades. Traditional brands rent attention. CSOP brands buy loyalty through ownership.

When you aggregate 20 creators under one cap table, you're not building a brand. You're building a media conglomerate that happens to sell products. And in a world where organic reach is dying and paid ads are losing effectiveness, this isn't just the future, it's the only viable path forward.

The brands that understand this will dominate their categories. The ones that don't will wonder why their $10M ad budgets can't compete with 20 creators who actually care.

Welcome to the new playbook.

The Mic Drop

Feastables Drops Chocolate Milk & Sour Strike Gummies

MrBeast’s snack brand Feastables just expanded beyond chocolate bars with two new products: Real Chocolate Milk and Sour Strike Gummies. Both stick to the brand’s clean label promise with simple ingredients and no artificial flavors while aiming to capture the growing demand for better-for-you treats. Early retail reports show nationwide rollout this fall, marking another step in MrBeast’s plan to turn Feastables into a full-scale snacking empire.

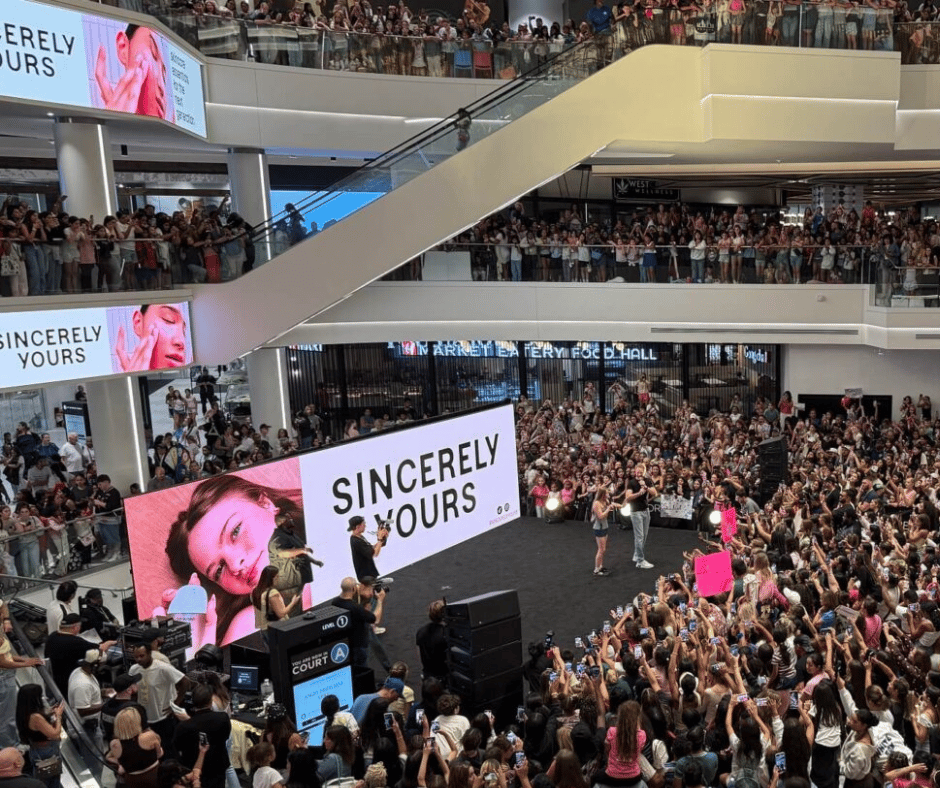

80,000 People Show Up for Salish Matter’s Sincerely Yours Launch

Fifteen-year-old creator Salish Matter launched her teen-focused skincare brand Sincerely Yours with an exclusive Sephora rollout and a massive in-person event at American Dream Mall. Reports estimate around 80,000 people showed up for the debut, with fans lining up hours before doors opened to snag the dermatologist-tested cleanser, moisturizer, SPF, and hydrating mist made specifically for teen skin. The turnout highlights how Salish’s 6 million-plus followers translate into real-world demand and positions Sincerely Yours as a breakout in the $180 billion beauty market.

Gwyneth Paltrow Launches New Fashion Line

Gwyneth Paltrow is entering the fashion world again with her new line, Gwyn, following the wind-down of her previous G. Label under Goop. The collection features 36 pieces, including thick knit sweaters, cashmere polos, and Italian-made outerwear like navy peacoats and British-inspired anoraks. This isn’t a quick celebrity capsule; it’s a thoughtfully curated, high-quality line aimed at long-term brand-building in fashion.

HotStart VC’s Backstage Pass

Looking to Build a Creator Equity Pool or Secure Equity Deals

If you're a brand looking to create a creator equity pool or a creator/manager seeking equity opportunities in startups, I recommend checking out OWM. OWM is a platform that brings creators and brands together to structure meaningful equity partnerships that align long-term incentives. As someone who has been structuring equity deals between creators and startups for 4+ years, I’m very impressed with what they’ve built and proud to be a small angel investor. Explore more about their offerings here.

Betr, Co-Founded by Jake Paul, Launches Social Sportsbook

Portfolio company Betr, co-founded by Jake Paul, is officially live. The social sportsbook brings a peer-to-peer, real-money twist to fantasy sports, letting users compete with friends and other fans nationwide. This marks a major step in creator-led gaming, combining social engagement with real stakes, and sets the stage for new products, content, and expanded state launches in the months ahead.

HotStart VC in Lisbon, Portugal

I’ll be in Lisbon from September 27–30. If you’re in the area, we’d love to connect and chat about creator- and celebrity-founded brands, partnership opportunities, or just say hi.

Take #11

The creator equity revolution isn't about percentages; it's about alignment. Smart brands aren't asking "Which creator should we recruit?" They're asking, "How do we structure ownership so 20 creators become co-owners of our brand?"

Here's what we've learned: The brands that gave creators 2% each with no coordination failed. The ones that pooled 10-15% equity across 20 creators with shared milestones and collective goals? They're category leaders.

The formula: Create one equity pool. Vest over deliverables. Tie rewards to collective performance. Add accelerators for viral moments. Build in anti-compete clauses.

Remember: In a world where creators chase the next shiny object, shared ownership isn't just smart. It's survival.

Welcome to the inside track,

Scott

P.S. Need help building a creator stock option pool? Or know a brand crushing it with CSOP? Hit reply. I read everything.

—----

About HotStart VC

HotStart VC is launching a new fund to invest in brands founded by celebrities and creators. We’re building the go-to platform for creators and celebrities launching brands, providing capital, strategic support, and the infrastructure to scale.