The Red Carpet

The Fame Game

Welcome back to The Fame Game, where we decode how celebrities build billion-dollar businesses. This week, we're pulling back the curtain on a counterintuitive reality: why most celebrity-founded brands aren’t venture capital backable, and the rare exceptions that prove the rule.

Here's what makes this perspective unique: I run HotStart VC, a fund that exclusively invests in celebrity and creator-founded brands. You'd think I'd be evangelizing for every celebrity to raise venture capital. But after evaluating hundreds of celebrity-founded brands and watching too many flame out, I've learned that the best advice I can give most celebrities is this: don't take VC funding. The irony isn't lost on me, a VC telling celebrities not to raise venture capital, but understanding why is crucial to building a sustainable celebrity-founded business.

Let's dive into today's topic.

The Director's Cut

The VC Math That Doesn't Add Up for Most Celebrity-Founded Brands

It seems like every celebrity launches a brand these days. From tequila to skincare to athleisure, the playbook appears simple: leverage fame, launch product, profit. But here's what most people miss: the vast majority of these brands aren't built for venture-scale returns, and that's actually fine.

Venture capitalists need 20x returns minimum. They're not looking for steady $50M businesses; they need potential billion-dollar outcomes. This creates a fundamental mismatch with how most celebrity-founded brands operate.

The Six VC Dealbreakers:

Venture capitalists back businesses with the potential for massive scale, defensibility, and long-term returns. They want to see strong leadership, operational excellence, and business models that can deliver exponential growth, not just short-term buzz or profitability.

Most celebrity-founded brands don’t meet those criteria. They’re often powered by fame rather than fundamentals, which leads to six common dealbreakers:

🚫 The Founder Dependency Trap

The Jessica Simpson Collection did $1B in retail sales, then collapsed when she reduced her involvement. Sequential Brands bought it for $117M, couldn't revive it without her, and sold it back to Simpson for $65M. The pattern is clear: celebrity presence drives performance. Celebrity absence drives bankruptcy.

📈 The Moat Problem

George Clooney's Casamigos sold for $1B, inspiring dozens of celebrity tequila brands. But here's the issue: there's no real defensibility. Anyone can source good tequila, design a nice bottle, and leverage distribution relationships. Without proprietary technology, unique IP, or network effects, these brands lack the competitive advantages VCs seek, especially in beauty, apparel, and wellness.

🤡 Amateur Hour Operations

Lindsay Lohan's Fornarina launched with her mom as business manager and her personal assistant running operations. Result? The fashion line folded in under a year after inventory pileups and missed deliveries. Compare that to Beats by Dre, which brought in Jimmy Iovine and Monster Cable's engineering team from day one. VCs don't invest in entourages playing business; they invest in operators who happen to have celebrity partners.

📉 One-Hit Wonder Economics

Prime sold hundreds of millions of bottles in its first 24 months. After month 24? Sales dropped 70% as the hype faded. Repeat purchase rate: 12%. The product became a meme rather than a beverage people actually wanted to drink regularly. Meanwhile, Aviation Gin (pre-Reynolds) had a 45% repeat rate. VCs live and die by LTV/CAC ratios. When your customers buy once for Instagram and never return, the math breaks.

💰 The Growth vs. Profit Paradox

Many celebrity-founded brands become profitable lifestyle businesses doing $5-10M in annual revenue. That's fantastic for the celebrity, but poison for VC returns. Venture capital funds hypergrowth, not profitability. If you're making money but not doubling year-over-year, you're not venture-backable.

⏰ The Patience Problem

Jessica Simpson Collection lost money for 7 years before becoming profitable. Skims burned $100M before breaking even. But most celebrities expect profits in year one, like 50 Cent's SMS Audio, which shut down after 18 months of losses. Building a real brand takes time that most celebrities won't commit to.

Framework: The Celebrity-Founded Brand VC Checklist

So what separates VC-backable celebrity brands from lifestyle businesses? Here's the framework we use at HotStart:

✅ Market Size: Is it a $10B+ opportunity?

Skims attacked the $68B global underwear market

Fenty Beauty targeted the $532B global beauty market

Most celebrity wines target a $2B premium segment (too small)

✅ Innovation: Does it solve a real problem?

Fenty Beauty: 40 foundation shades when competitors had 6-8

Skims: Shapewear that actually fits diverse body types

Pattern by Tracee Ellis Ross: Haircare specifically formulated for textured hair

✅ Defensibility: Is there IP or a true moat around the brand?

FYR by Derek Wolf: Spent 2+ years developing a patented modular grill system designed for live-fire cooking

NexTide by Jerome Aceti: Spent 2 years developing a patented safety tool for livestreamers

Most celebrity brands: White-labeled products with no unique IP, easy to copy, and hard to scale

✅ Independence: Can it scale without the celebrity founder?

Beats by Dre: Built a brand bigger than Dr. Dre himself

The Honest Company: Jessica Alba stepped back, and the company went public

Rare Beauty: Selena Gomez built a mental health mission beyond herself

✅ Unit Economics: Do the margins support venture growth?

Software-like margins (70%+): Masterclass courses

Premium pricing power: Skims bras at $68 vs. market average of $25

Subscription potential: Chris Hemsworth's Centr fitness app

✅ Team: Are industry veterans in charge?

Fenty Beauty: Ex-LVMH president as CEO, not Rihanna's manager

Aviation Gin: Diageo's former brand director, not Reynolds' agent

Skims: Ex-Nike and Levi's executives running operations

The Exceptions That Prove the Rule:

Only a handful of celebrity-founded brands have achieved venture-scale success:

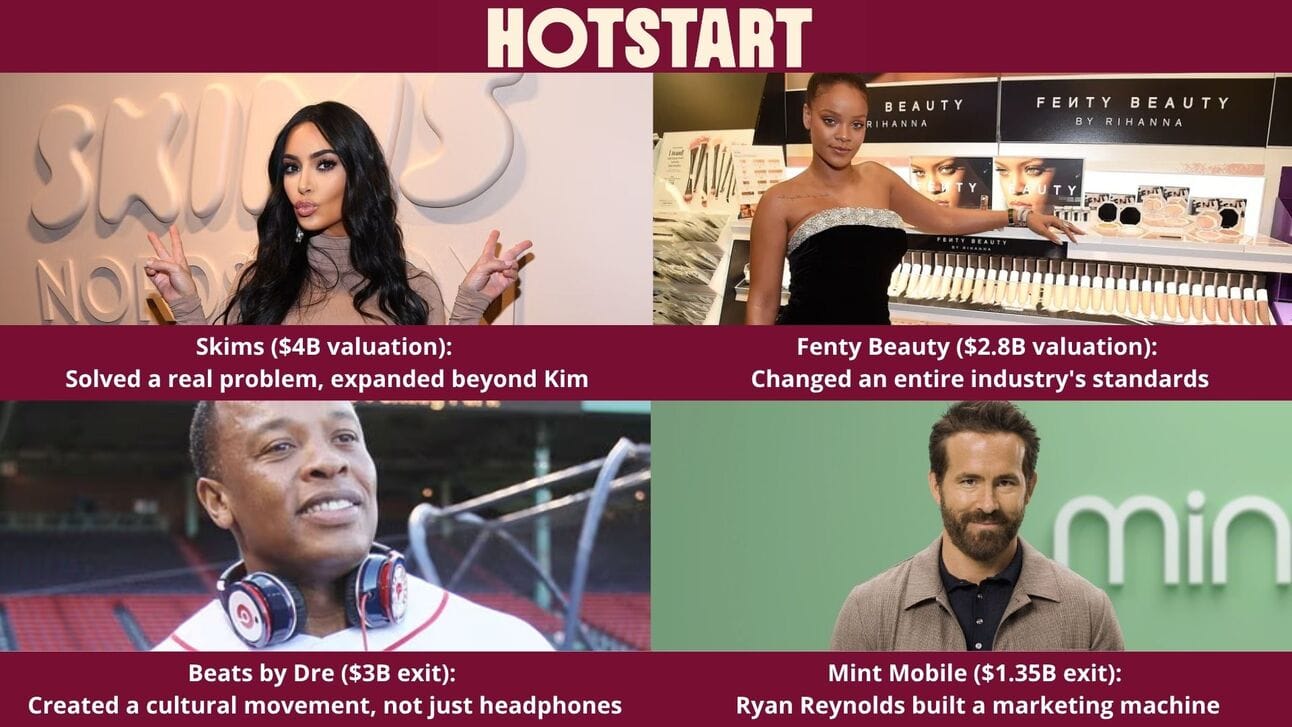

Skims ($4B valuation): Solved a real problem, expanded beyond Kim

Fenty Beauty ($2.8B valuation): Changed an entire industry's standards

Beats by Dre ($3B exit): Created a cultural movement, not just headphones

Mint Mobile ($1.35B exit): Ryan Reynolds built a marketing machine

What made these different? They weren't just celebrity endorsements with better cap tables. Each one fundamentally disrupted its category.

Skims reinvented shapewear

Fenty forced beauty brands to expand shade ranges

Beats made headphones a fashion statement

Mint Mobile turned telecommunication marketing into entertainment

These brands worked because they did what venture-backed startups are supposed to do: solve real problems at scale, shift consumer behavior, and build something bigger than the celebrity behind them. The fame helped accelerate growth, but it wasn’t the foundation. The business was. That’s what makes them VC-backable and capable of billion-dollar outcomes.

When Venture Capital Becomes a Ticking Clock

When a handful of celebrity-founded brands like the above hit billion-dollar outcomes, it creates a powerful illusion: “If they did it, I should raise too.”

Skims, Fenty, Beats, those stories make it seem like the formula is simple: build a brand, raise a round, scale like a startup. So more and more celebrities try to follow the same path, chasing VC money before proving if their business can actually sustain VC growth.

Raising money feels like winning. Headlines roll in. Valuation jumps. Teams scale.

But for celebrity-founded brands, that money comes with a timer, and it’s counting down fast.

The minute VC money lands, growth isn’t optional. It’s expected.

You’re supposed to double every year.

You’re supposed to expand into new categories.

You’re supposed to turn hype into hockey-stick revenue.

But what if the brand isn’t built for that?

Marketing budgets balloon. Products launch before they’re ready. Retail deals get rushed. Suddenly, the brand that once felt intimate and trusted now feels… everywhere. And not in a good way.

Worse, many celebrity-founded brands raise at premium valuations driven by name recognition, not business fundamentals. When growth lags, they can't grow into those numbers. Down rounds follow. Equity gets diluted. And just like that, control starts to slip away.

Your burn rate eats your margins.

Your valuation becomes a trap.

And investors want their money back, fast.

They’ll push for new leadership. New direction. Or an exit you never wanted.

Venture capital can accelerate a great business. But it can’t create one.

And when the growth doesn’t come fast enough, the crash is twice as hard, especially if you raised too early.

The better move? Delay the raise.

Focus on product-market fit.

See if there’s real, venture-scale demand hiding behind the fame.

And only then, decide if venture capital is fuel or fire.

The Bottom Line

Here's the truth that took me years of pattern recognition to accept: Most celebrity-founded brands shouldn't raise venture capital, and that's not a bug, it's a feature.

Venture capital requires 20x returns. That means celebrity-founded brands need a clear path to a billion-dollar valuation. If you're building a $20M lifestyle brand that generates $3M in annual profit? That's an incredible business, just not a venture business.

The next time a celebrity asks me about raising venture capital, my first question isn't "How much do you want to raise?" It's "Are you building a brand extension or a category killer?" Because only one of those deserves venture funding.

The Mic Drop

The Chainsmokers Just Raised a $100M Fund III

While most celebrity investors chase headlines, The Chainsmokers are building a legit VC empire. With $215M+ under management across three funds, they’ve quietly become one of the most credible creator-led firms in tech. Their edge? Turning fame into distribution, access, and actual startup value. Read my full breakdown here.

Sydney Sweeney Is Launching a Lingerie Brand—Backed by Jeff Bezos

This isn’t a celebrity vanity play. After testing demand with a sellout swimwear collab, Sydney Sweeney is going all in, building a lingerie brand that matches her on-screen persona and real audience demand. The kicker? It’s reportedly funded by Coatue’s new $1B fund, with Bezos and Dell as backers. This is the new blueprint for celebrity–product–market fit. Read my full breakdown here.

Kaley Cuoco’s Pet Brand Oh Norman! Just Raised $2M With Backing From Mars Petcare and More

Kaley Cuoco isn’t just lending her name; she’s building a mission-led pet brand from the ground up. Oh Norman! just closed a $2M round backed by Mars Petcare, Tractive’s founder, Leap Ventures, and even Brown University. It’s a powerful signal that this isn’t just a celebrity side hustle—it’s a serious play in the $300B+ pet care market. Read the full story here.

HotStart VC’s Backstage Pass

We made an angel investment in Standard Giving Co., co-founded by Zachary Dereniowski.

Standard Giving Co. is a new platform that helps brands and creators give directly to people in financial distress, instantly, transparently, and in a way that drives emotional storytelling and brand impact. The company was co-founded by one of the world's largest kindness creators, Zachary Dereniowski (33M+ followers), and experienced operators from the philanthropy and tech sectors.

Venture Partners Sasha Pieterse & Alexandra Wildeson Open Up on Chronic Illness and HotStart VC on the WITN Podcast

In this candid conversation, Sasha Pieterse and Alexandra Wildeson dive deep into the challenges of living with chronic illness while navigating the fast-paced business world. Alex shares her journey advocating for herself amid invisible health struggles and the emotional resilience it demands. Midway through (at 43:42), they shift gears just to talk about HotStart VC. Full podcast here.

Take #3

Most celebrity-founded brands capture attention, but few capture the fundamentals that venture capital demands. Their early hype often masks critical weaknesses: reliance on fame instead of product, shaky unit economics, and impatience for sustainable growth.

VCs seek scalable, defensible businesses led by operators who can build beyond the celebrity’s spotlight. Without these, venture capital becomes more risk than reward, pushing brands into growth traps they aren’t ready for.

The reality is simple: celebrity status alone does not equal venture-backable business. True VC potential lies in the depth of the product, the strength of the team, and the durability of the brand.

At HotStart VC, we want to back celebrities who understand this distinction. The ones that combine the power of influence with real business fundamentals and the vision to build for the long game.

Those are the businesses that can break the mold and truly scale..

Welcome to the fame game,

Scott

P.S. Have a celebrity-founded brand you think I should analyze? Or a founder I should meet? Hit reply. I read everything.

—----

About HotStart VC

HotStart VC is launching a new fund to invest in brands founded by celebrities and creators. With HotStart, we’re building the go-to platform for creators and celebrities launching brands, providing capital, strategic support, and the infrastructure to scale.